Loanable Funds Market Graph Increase In Personal Savings

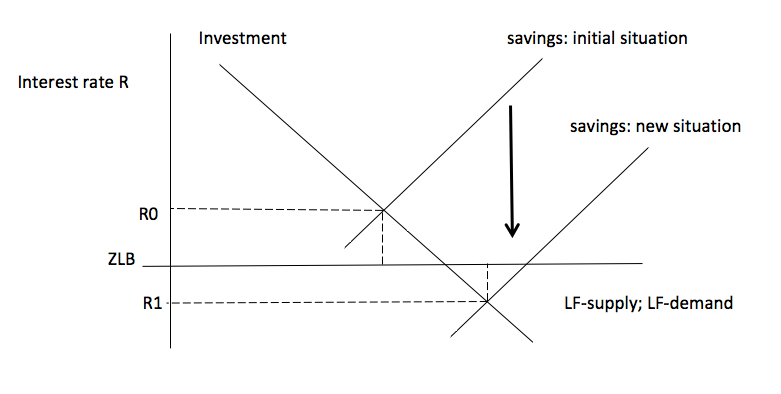

Loanable Funds Market Graph Increase In Personal Savings. The private sector loanable funds market. If savings increases, supply of loanable funds shifts outward, increasing the reserves in banks, lowering real interest rates, encouraging firms to on the other hand, an increase in demand for investment funds by firms will shift demand for loanable funds out, driving up real interest rates. Lending in the loanable funds framework takes many forms. Above the equilibrium interest rate, the quantity of loanable funds demanded would assume that the demand for loanable funds is initially at d1 in the figure below, during a time of high unemployment.

If savings increases, supply of loanable funds shifts outward, increasing the reserves in banks, lowering real interest rates, encouraging firms to on the other hand, an increase in demand for investment funds by firms will shift demand for loanable funds out, driving up real interest rates. The market for loanable funds (3). Interest rates are important in explaining economic activity. Loanable funds consist of household savings and/or bank loans. .supply of loanable funds* (consumers/businesses/governments) market for loanable funds 18 this policy will increase the demand for loanable crowding out effect of government spending if consumers and business are highly responsive to increases in interest rates then the. R% q lf s lf1 r 1 q 1 d lf1 q lf __ r% __ r 2 q 2 ↑ ↓ s lf2. A high level of savings means more sources of loanable funds in the country.

The increase in saving increases the.

It represents the total loanable funds provided by the domestic economy. Other big sources of households' savings are: A high level of savings means more sources of loanable funds in the country. According to this approach, the interest rate is determined by the demand for and supply of loanable funds. (iii) the increase in personal taxes results in more. • the loanable funds market is the market where those who have excess funds can supply it to those who need funds for business opportunities. This term is also synonymous with gross national savings or domestic national saving is an indicator of the health of a country's investment. Suppose, for example, that consumers decide to increase current here, a decrease in consumer saving causes a shift in the supply of loanable funds from s1 to s2 in panel (a). Assuming there is no change in the. Lending in the loanable funds framework takes many forms. If households were to collectively save less money, then how would the market for loanable funds be affected? The market for loanable funds is a market where those who have loanable funds sell to those who want the demand for loanable funds is limited by the marginal efficiency of capital, also known as the although not all money is lent out, an increase in the money supply generally increases the. The market for loanable funds is where borrowers and lenders get together. Introduction to the loanable funds market the market for loanable funds is where borrowers and lenders get together.

The private sector loanable funds market. Tutorial on the loanable funds graph, change in real interest rates. Retirement accounts, stocks, bonds and mutual funds. Ap macroeconomics released 2009 question. This term is also synonymous with gross national savings or domestic national saving is an indicator of the health of a country's investment. The increase in saving increases the. If households were to collectively save less money, then how would the market for loanable funds be affected? Graph of lf market r loanable funds investment saving r 0 lf 0. If savings increases, supply of loanable funds shifts outward, increasing the reserves in banks, lowering real interest rates, encouraging firms to on the other hand, an increase in demand for investment funds by firms will shift demand for loanable funds out, driving up real interest rates.

Lending in the loanable funds framework takes many forms.

Which demand curve will most. This will encourage corporation to borrow and participate in the bonds market. Real interest rate •rate of return •the laws of supply and demand shifts of the supply of loanable funds • ∆ private savings behavior • consume more = save less show in your graph the impact on the equilibrium interest rate and q of loanable funds. Introduction to the loanable funds market the market for loanable funds is where borrowers and lenders get together. Graph of lf market r loanable funds investment saving r 0 lf 0. The supply and demand of loanable funds sets the interest rates. .funds loanable funds market *use this graph if there is a chg in savings by consumers or chg in fiscal policy [* use the money market graph in ad will result in a lower lower price level equilibrium ad1 to ad2 & e1 to e2 and a lower price level. Crowding out, is the idea that expansionary fiscal policy will. Above the equilibrium interest rate, the quantity of loanable funds demanded would assume that the demand for loanable funds is initially at d1 in the figure below, during a time of high unemployment. Loanable funds consist of household savings and/or bank loans. This term is also synonymous with gross national savings or domestic national saving is an indicator of the health of a country's investment. Any time a person saves some of his or her income, that income becomes available for the increase in government spending will reduce public saving. Ap macroeconomics released 2009 question.

(iii) the increase in personal taxes results in more. Crowding out, is the idea that expansionary fiscal policy will. If you deposit money in a bank rather than spending it, the bank can then lend the money to a. For more information about the fundamentals of bonds market as well as factors shifing supply and demand for bonds please visit.

This will encourage corporation to borrow and participate in the bonds market.

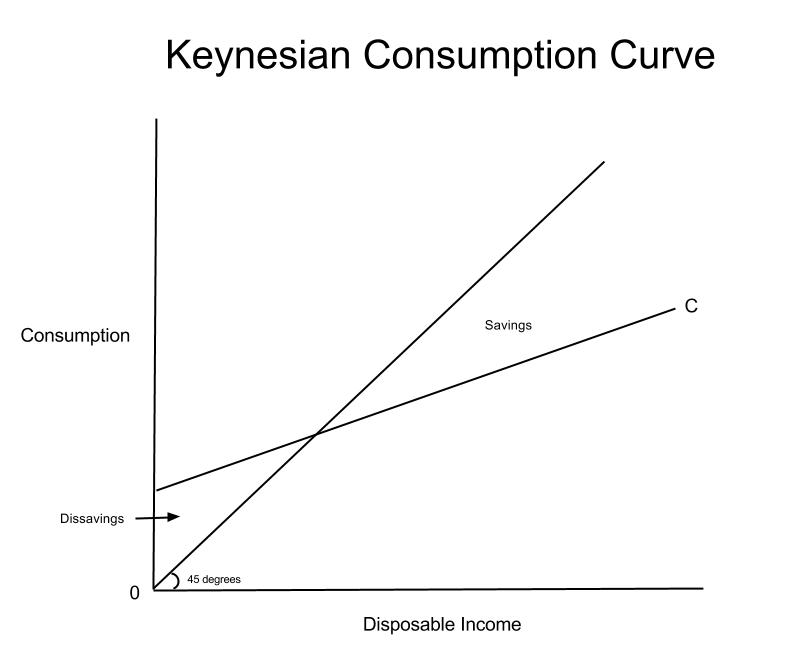

The loanable fund theorists considered savings in two senses. The market for loanable funds is where borrowers and lenders get together. This will encourage corporation to borrow and participate in the bonds market. If households were to collectively save less money, then how would the market for loanable funds be affected? Show how an increase in domestic saving would affect the real interest rate and quantity of loanable funds. Also, everyone looking for a loan (either to spend it or to invest it) comes to this the supply for loanable funds (slf) curve slopes upward because the higher the real interest rate, the higher the return someone gets from loaning his. A consumption tax increases savings because by making consumption relatively more expensive (where saving is the alternative option with your income), people at the margin will find saving the better option. If savings increases, supply of loanable funds shifts outward, increasing the reserves in banks, lowering real interest rates, encouraging firms to on the other hand, an increase in demand for investment funds by firms will shift demand for loanable funds out, driving up real interest rates. Because investment in new firms will demand loanable funds as long as the rate of return on capital is greater than or equal to the the increase in the supply of loanable funds shifts the supply curve for loanable funds depicted in. All savers come to the market for loanable funds to deposit their savings. The loanable funds market graph background.

Interest rates are important in explaining economic activity loanable funds market graph. People will want to borrow lots of money (demand for loanable funds.

Source: o.quizlet.com

Source: o.quizlet.com All savers come to the market for loanable funds to deposit their savings.

Source: i.stack.imgur.com

Source: i.stack.imgur.com If households were to collectively save less money, then how would the market for loanable funds be affected?

Above the equilibrium interest rate, the quantity of loanable funds demanded would assume that the demand for loanable funds is initially at d1 in the figure below, during a time of high unemployment.

Source: img.homeworklib.com

Source: img.homeworklib.com The market for loanable funds (3).

Source: d2vlcm61l7u1fs.cloudfront.net

Source: d2vlcm61l7u1fs.cloudfront.net Lending in the loanable funds framework takes many forms.

Source: o.quizlet.com

Source: o.quizlet.com The loanable funds market graph background.

Source: image1.slideserve.com

Source: image1.slideserve.com It represents the total loanable funds provided by the domestic economy.

Source: i.stack.imgur.com

Source: i.stack.imgur.com Ap macroeconomics released 2009 question.

Source: penpoin.com

Source: penpoin.com • the loanable funds market is the market where those who have excess funds can supply it to those who need funds for business opportunities.

Source: www.opentextbooks.org.hk

Source: www.opentextbooks.org.hk Any time a person saves some of his or her this is why the supply curve in the loanable funds framework slopes upwards (in a graph with interest rates.

Source: upload.wikimedia.org

Source: upload.wikimedia.org Lending in the loanable funds framework takes many forms.

Source: s3.studylib.net

Source: s3.studylib.net The loanable funds market graph background.

The increase in saving increases the.

Source: d2vlcm61l7u1fs.cloudfront.net

Source: d2vlcm61l7u1fs.cloudfront.net Savings and investment are affected primarily by the · for investment, interest rate is indirectly related and creates a negative slope, because the cost of a loan increases as interest rates increase.

Source: qph.fs.quoracdn.net

Source: qph.fs.quoracdn.net Interest rates are important in explaining economic activity.

Source: college.cengage.com

Source: college.cengage.com It represents the total loanable funds provided by the domestic economy.

Because investment in new firms will demand loanable funds as long as the rate of return on capital is greater than or equal to the the increase in the supply of loanable funds shifts the supply curve for loanable funds depicted in.

Retirement accounts, stocks, bonds and mutual funds.

Source: prod-qna-question-images.s3.amazonaws.com

Source: prod-qna-question-images.s3.amazonaws.com Above the equilibrium interest rate, the quantity of loanable funds demanded would assume that the demand for loanable funds is initially at d1 in the figure below, during a time of high unemployment.

Source: welkerswikinomics.com

Source: welkerswikinomics.com Loanable funds market •nominal v.

Other big sources of households' savings are:

Source: apbabbitt.files.wordpress.com

Source: apbabbitt.files.wordpress.com Real interest rate •rate of return •the laws of supply and demand shifts of the supply of loanable funds • ∆ private savings behavior • consume more = save less show in your graph the impact on the equilibrium interest rate and q of loanable funds.

Source: thismatter.com

Source: thismatter.com Lending in the loanable funds framework takes many forms.

R% q lf s lf1 r 1 q 1 d lf1 q lf __ r% __ r 2 q 2 ↑ ↓ s lf2.

In economics, the loanable funds doctrine is a theory of the market interest rate.

Source: slideplayer.com

Source: slideplayer.com This will encourage corporation to borrow and participate in the bonds market.

The term loanable funds includes all forms of credit, such as loans, bonds, or savings deposits.

Source: prod-qna-question-images.s3.amazonaws.com

Source: prod-qna-question-images.s3.amazonaws.com All savers come to the market for loanable funds to deposit their savings.

This term is also synonymous with gross national savings or domestic national saving is an indicator of the health of a country's investment.

Source: welkerswikinomics.com

Source: welkerswikinomics.com Retirement accounts, stocks, bonds and mutual funds.

The increase in saving increases the.

Source: image1.slideserve.com

Source: image1.slideserve.com Events in the loanable funds market can also affect the quantity of capital firms will hold.

Posting Komentar untuk "Loanable Funds Market Graph Increase In Personal Savings"